In the realm of private equity, where informed decision-making, strategic investments, and maximizing returns are paramount, the integration of innovative technologies has become increasingly crucial. Among these technologies, enterprise generative AI solutions stand out as powerful tools with the potential to revolutionize various facets of private equity operations. In this comprehensive guide, we will delve into the benefits and pivotal role of enterprise generative AI solution for private equity firms, exploring how they drive value, optimize processes, and enhance decision-making capabilities.

Introduction

Private equity firms operate in a dynamic and competitive landscape, where success hinges on the ability to identify lucrative investment opportunities, execute strategic transactions, and generate superior returns for investors. In today’s digital age, where data is abundant and insights are paramount, leveraging advanced technologies such as enterprise generative AI solutions has become imperative for staying ahead of the curve. These AI-powered tools offer private equity firms the ability to gain actionable insights, automate repetitive tasks, and unlock new opportunities for value creation. Let’s explore the myriad benefits and the pivotal role of enterprise generative AI solution for private equity.

Understanding Enterprise Generative AI Solutions

Enterprise generative AI solutions are sophisticated software platforms that harness the power of artificial intelligence to generate new insights, ideas, and recommendations autonomously. Unlike traditional AI systems, which are limited to analyzing existing data and making predictions based on historical patterns, generative AI solutions have the capability to create new data, content, and ideas through techniques such as deep learning, natural language processing (NLP), and generative modeling. These AI-powered tools enable private equity firms to analyze complex data sets, uncover hidden patterns, and make informed decisions with greater accuracy and efficiency.

Benefits of Enterprise Generative AI Solutions for Private Equity

Enterprise generative AI solution for private equity offers firms a wide range of benefits, including:

1. Enhanced Due Diligence and Deal Sourcing

Generative AI solutions enable private equity firms to conduct more comprehensive due diligence and identify lucrative investment opportunities with greater speed and accuracy. By analyzing vast amounts of data, including financial statements, market trends, and industry reports, these solutions can uncover valuable insights and identify potential risks and opportunities early in the deal lifecycle, enabling firms to make more informed investment decisions.

2. Improved Investment Analysis and Decision Making

Generative AI solutions empower private equity firms to analyze investment opportunities more effectively and make data-driven decisions with confidence. By leveraging advanced analytics and machine learning algorithms, these solutions can analyze complex financial models, perform scenario analysis, and evaluate investment risks and returns in real-time, enabling firms to optimize their investment strategies and maximize returns for investors.

3. Portfolio Optimization and Value Creation

Generative AI solutions help private equity firms optimize their investment portfolios and drive value creation across their portfolio companies. By analyzing operational data, market trends, and competitive dynamics, these solutions can identify opportunities for growth, efficiency improvements, and strategic initiatives that enhance the value of portfolio companies and drive long-term returns for investors.

4. Risk Management and Compliance

Generative AI solutions enable private equity firms to manage risks more effectively and ensure compliance with regulatory requirements. By analyzing market data, regulatory filings, and industry benchmarks, these solutions can identify potential risks and compliance issues early on, enabling firms to take proactive measures to mitigate risks and avoid regulatory penalties.

5. Enhanced Investor Relations and Reporting

Generative AI solutions help private equity firms enhance investor relations and reporting by providing timely, accurate, and transparent information to investors. By automating the process of data collection, analysis, and reporting, these solutions can streamline investor communications, improve transparency, and build trust with investors, leading to stronger relationships and increased investor confidence.

Role of Enterprise Generative AI Solutions in Private Equity

Enterprise generative AI solution for private equity plays a pivotal role in enabling private equity firms to achieve their strategic objectives and drive value for investors. Some key roles of these solutions include:

1. Strategic Decision Support

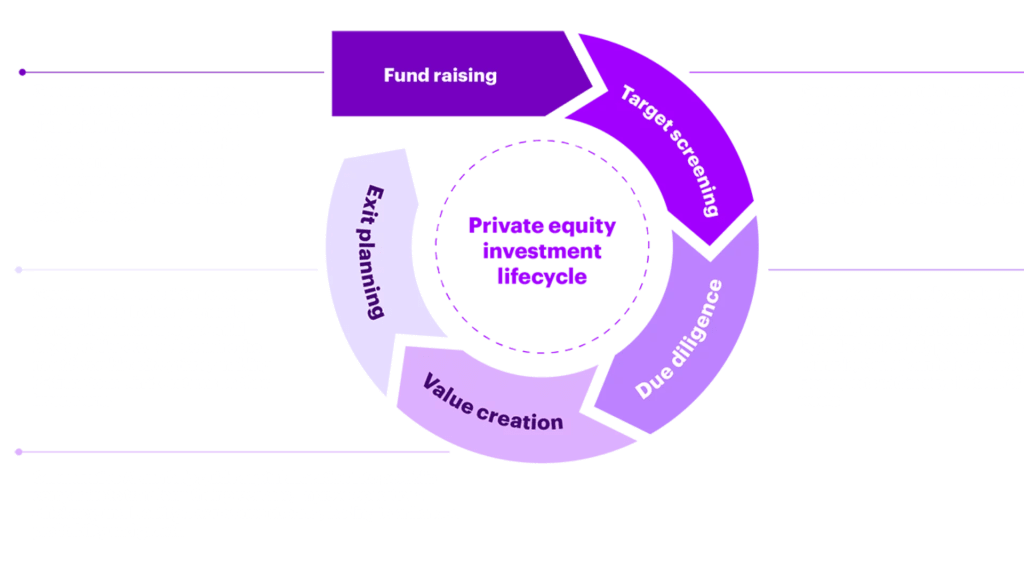

Generative AI solutions provide private equity firms with valuable insights and recommendations that inform strategic decision-making across all aspects of the investment lifecycle, from deal sourcing and due diligence to portfolio management and exit planning. By leveraging advanced analytics and machine learning algorithms, these solutions enable firms to identify trends, patterns, and opportunities that drive value creation and competitive advantage.

2. Operational Efficiency and Automation

Generative AI solutions help private equity firms streamline their operations, automate repetitive tasks, and optimize processes, leading to increased efficiency, productivity, and cost savings. By automating tasks such as data collection, analysis, and reporting, these solutions free up valuable time and resources, enabling firms to focus on high-value activities that drive growth and profitability.

3. Risk Management and Compliance

Generative AI solutions enable private equity firms to manage risks more effectively and ensure compliance with regulatory requirements. By analyzing vast amounts of data and identifying potential risks and compliance issues early on, these solutions help firms mitigate risks, avoid regulatory penalties, and safeguard their reputation and credibility with investors and stakeholders.

4. Portfolio Optimization and Value Creation

Generative AI solutions help private equity firms optimize their investment portfolios and drive value creation across their portfolio companies. By analyzing operational data, market trends, and competitive dynamics, these solutions identify opportunities for growth, efficiency improvements, and strategic initiatives that enhance the value of portfolio companies and maximize returns for investors.

5. Investor Relations and Reporting

Generative AI solutions enable private equity firms to enhance investor relations and reporting by providing timely, accurate, and transparent information to investors. By automating the process of data collection, analysis, and reporting, these solutions streamline investor communications, improve transparency, and build trust with investors, leading to stronger relationships and increased investor confidence.

Challenges and Considerations

While enterprise generative AI solution for private equity offers significant benefits to private equity firms, they also come with challenges and considerations that must be addressed, including:

1. Data Privacy and Security

Generative AI solutions require access to vast amounts of sensitive data, raising concerns about data privacy, security, and compliance with regulations such as GDPR and CCPA. Private equity firms must implement robust data protection measures and ensure compliance with relevant regulations to safeguard confidential information and protect against data breaches.

2. Bias and Fairness

Generative AI solutions are susceptible to bias and unfairness, which can lead to unintended consequences and negative outcomes for investors and stakeholders. Private equity firms must implement measures to detect and mitigate bias in AI algorithms, such as algorithmic audits, fairness testing, and diverse training data sets, to ensure fair and unbiased decision-making.

3. Integration and Adoption

Private equity firms may face challenges in integrating and adopting generative AI solutions into their existing workflows and systems. Firms must invest in training and development programs to upskill their teams and ensure they have the necessary expertise to leverage AI technologies effectively.

4. Ethical and Social Implications

Generative AI solutions raise ethical and social implications, including concerns about job displacement, algorithmic bias, and the impact on society and culture. Private equity firms must consider the ethical implications of AI technologies and ensure they align with their values and principles.

Future Outlook

Despite these challenges, the future outlook for enterprise generative AI solutions in private equity is promising. As technology continues to evolve and mature, generative AI solutions are expected to become more advanced, sophisticated, and accessible, enabling private equity firms to unlock new opportunities and drive innovation in the industry.

Conclusion

In the dynamic landscape of private equity, enterprise generative AI solutions play a pivotal role in driving value, optimizing processes, and enhancing decision-making capabilities. These solutions offer a multitude of benefits, including enhanced due diligence, improved investment analysis, and portfolio optimization. Their role extends to strategic decision support, operational efficiency, and risk management. Despite challenges such as data privacy and bias, the future outlook for generative AI solutions in private equity is promising. With continued innovation and adoption, these solutions will continue to empower private equity firms to navigate complexities, unlock opportunities, and deliver superior returns for investors.

Leave a comment