Introduction

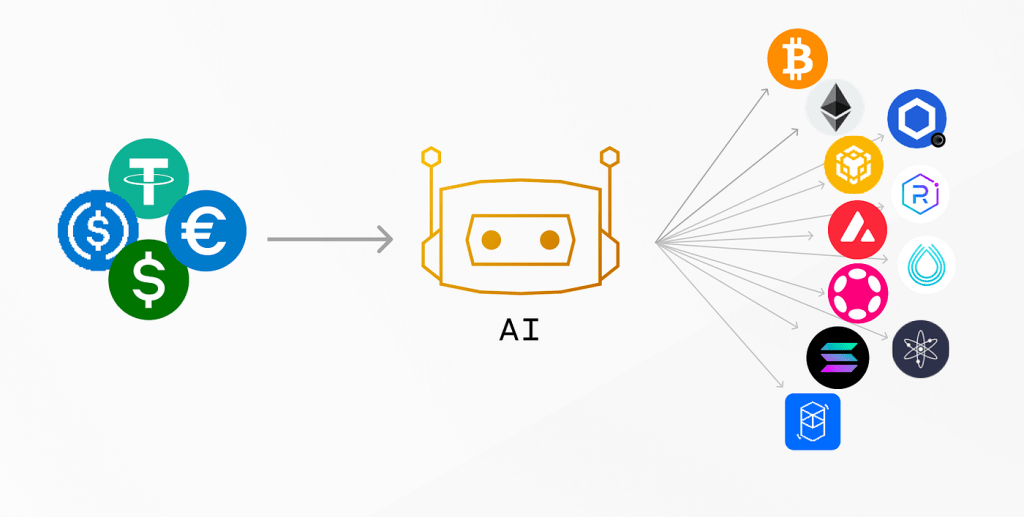

Portfolio management is a crucial aspect of financial planning and investment strategy. It involves the careful selection and management of a combination of assets to achieve specific financial objectives. In recent years, Artificial Intelligence (AI) has emerged as a powerful tool in the realm of portfolio management, revolutionizing the way investors approach decision-making and risk management.

This article aims to provide a thorough understanding of portfolio management, followed by an in-depth exploration of the role of AI for portfolio management played in optimizing and enhancing portfolio strategies.

I. Portfolio Management: A Fundamental Overview

1.1 Definition and Objectives

Portfolio management is the art and science of making decisions about investment mix and policy, matching investments to objectives, asset allocation, and balancing risk against performance. The primary objectives include maximizing returns and minimizing risk through diversification.

1.2 Key Components of Portfolio Management

1.2.1 Asset Allocation

Asset allocation involves deciding how to distribute investments among various asset classes such as stocks, bonds, and cash equivalents. The goal is to create a well-balanced portfolio that aligns with the investor’s risk tolerance and financial goals.

1.2.2 Security Selection

This component focuses on selecting individual securities within each asset class. Investors need to conduct thorough research and analysis to identify securities that have the potential to contribute positively to the overall portfolio performance.

1.2.3 Risk Management

Risk management involves identifying, assessing, and mitigating risks associated with the investment portfolio. Diversification, hedging, and other strategies are employed to minimize potential losses.

1.2.4 Performance Monitoring

Regular monitoring and evaluation of portfolio performance are crucial to ensure it remains aligned with the investor’s goals. Adjustments may be necessary based on market conditions, economic indicators, and changes in the investor’s financial situation.

II. The Evolution of AI in Finance

2.1 Introduction to AI in Finance

AI has transformed the financial industry by providing advanced analytical tools and decision-making capabilities. In portfolio management, AI algorithms analyze vast amounts of data, identify patterns, and make predictions, allowing for more informed investment decisions.

2.2 Machine Learning in Finance

Machine Learning (ML), a subset of AI, is particularly influential in finance. ML algorithms learn from historical data to identify trends, correlations, and anomalies. In portfolio management, ML can assist in predicting market movements and optimizing investment strategies.

2.3 Natural Language Processing (NLP) in Financial Analysis

NLP enables computers to understand and interpret human language. In finance, NLP is used to analyze news articles, social media, and financial reports to gauge market sentiment and make predictions about stock prices and market trends.

III. The Role of AI in Portfolio Management

3.1 Automation of Routine Tasks

AI streamlines portfolio management by automating routine tasks such as data collection, analysis, and reporting. This allows portfolio managers to focus on strategic decision-making rather than spending time on manual processes.

3.2 Enhanced Data Analysis

AI’s ability to process vast amounts of data at high speeds surpasses human capabilities. This enables more sophisticated and comprehensive analysis, leading to better-informed investment decisions.

3.3 Predictive Analytics

AI algorithms can analyze historical market data to identify patterns and trends, facilitating predictive analytics. This helps investors anticipate market movements and make timely adjustments to their portfolios.

3.4 Risk Management and Mitigation

AI excels in risk management by identifying potential risks and suggesting strategies to mitigate them. Through advanced analytics, AI can assess the impact of various market scenarios on a portfolio, enabling proactive risk management.

3.5 Personalized Investment Strategies

One of the significant advantages of AI in portfolio management is its ability to create personalized investment strategies based on an individual investor’s goals, risk tolerance, and preferences. This tailoring enhances the likelihood of achieving specific financial objectives.

IV. Challenges and Ethical Considerations

4.1 Data Privacy and Security

The use of AI in portfolio management involves handling sensitive financial data. Ensuring robust data privacy and security measures is crucial to protect investors’ information from unauthorized access and cyber threats.

4.2 Overreliance on AI

While AI enhances decision-making, overreliance on automated systems poses a risk. It’s essential for investors and portfolio managers to maintain a balance, combining AI insights with human judgment to make well-rounded decisions.

4.3 Bias in AI Algorithms

AI algorithms may unintentionally incorporate biases present in historical data. This can lead to unfair outcomes and negatively impact investment decisions. Regular monitoring and adjustments are necessary to address and mitigate biases.

V. Case Studies: Successful Implementations of AI in Portfolio Management

5.1 Bridgewater Associates

Bridgewater Associates, one of the world’s largest hedge funds, utilizes AI algorithms for market analysis and decision-making. The firm’s success is attributed to its integration of AI technologies into various aspects of portfolio management.

5.2 BlackRock

BlackRock, a global investment management corporation, employs AI for risk management and portfolio optimization. The firm’s Aladdin platform utilizes machine learning to enhance investment decision processes.

VI. Future Trends in AI for Portfolio Management

6.1 Quantum Computing

The development of quantum computing holds immense potential for portfolio management. Quantum computers can process complex algorithms at unprecedented speeds, revolutionizing data analysis and optimization processes.

6.2 Explainable AI

As AI systems become more complex, the need for explainable AI is rising. Investors and regulators seek transparency in AI decision-making processes to understand how recommendations are generated and ensure accountability.

6.3 Continued Integration of Big Data

The use of big data in portfolio management will persist, with AI algorithms becoming increasingly adept at handling and extracting valuable insights from vast datasets.

VII. Conclusion

In conclusion, portfolio management is a dynamic field that has evolved significantly with the integration of AI technologies. The role of AI in portfolio management spans automation, enhanced data analysis, predictive analytics, risk management, and personalized investment strategies. While AI brings numerous benefits, challenges and ethical considerations must be addressed to ensure responsible and effective use. Looking ahead, the future of AI in portfolio management promises exciting developments, including quantum computing, explainable AI, and continued integration of big data. Investors and portfolio managers must stay abreast of these advancements to leverage the full potential of AI in optimizing and refining their investment strategies.

Leave a comment